- Budgeting

- Cash Management

- Consumer and Mortgage Loans

- Debt and Debt Reduction

- Time Value of Money 1: Present and Future Value

- Time Value of Money 2: Inflation, Real Returns, Annuities, and Amortized Loans

- Insurance 1: Basics

- Insurance 2: Life Insurance

- Insurance 3: Health, Long-term Care, and Disability Insurance

- Insurance 4: Auto, Homeowners, and Liability Insurance

- The Home Decision

- The Auto Decision

- Family 1: Money and Marriage

- Family 2: Teaching Children Financial Responsibility

- Family 3: Financing Children’s Education and Missions

- Investments A: Key Lessons of Investing

- Investments B: Key Lessons of Investing

The Hourglass Bottom

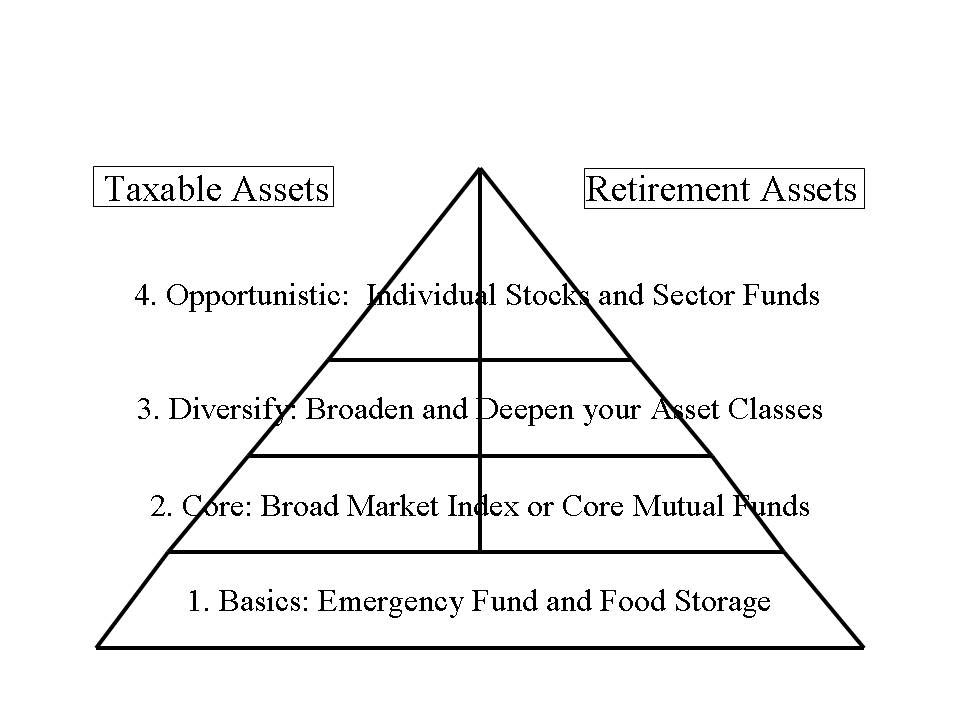

Strategies for developing investment portfolios differ among individual portfolio managers and institutions. The strategy each investor prefers depends on the way he or she views the market; an investor’s strategy also depends on his or her goals, budget, and experience in investing. It is impossible to discuss the strategies that every portfolio manager uses to build each portfolio; however, as I have reviewed successful portfolios, I have found that several critical phases of investment remain the same (see Chart 2). The top half of the hourglass detailed the steps you should take before you begin investing. Like the way we live our lives and decide on our goals, the way we invest should be based on our priorities. The bottom of the investment hourglass contains a pattern of successful portfolios that I have seen in my experience as I have worked with students, families, and institutions.

Chart 2: The Investment Hourglass Bottom

The bottom of the investment hourglass is divided into four levels, representing phases of investment. The first level of the hourglass represents the phase in which you develop your emergency fund and food storage. Here is where you build your reserve for emergencies and other needs. I strongly recommend that you build this phase first. Generally, it is recommended that you have three to six months of expenses in very liquid cash or cash equivalents (i.e., savings accounts, internet savings accounts, money market mutual funds, short-term CDs, etc.). For information on cash management vehicles, see the section on Cash and Liquid Asset Management from this website.

The second level represents the phase in which you develop your portfolio’s core, or broad exposure. This section generally gives you exposure to the least risky of all the equity asset classes, mainly large-capitalization mutual funds. I strongly recommend, when you first begin investing, that, instead of purchasing individual stocks and bonds, you follow the principles of investing discussed earlier and instead invest in low-cost, no-load index mutual funds, which will give you broad diversification (I prefer a minimum of 500 securities or more), market returns, and tax-efficient investments. For information on mutual funds, see the section on Investments 6: Mutual Fund Basics from this website.

The third level represents the phase in which you diversify your portfolio by broadening and deepening your asset classes. If your core allocation is large-capitalization stocks, to deepen your portfolio might be to include mutual funds which invested in small-capitalization or mid-capitalization stocks. If you were to broaden your asset classes, you might look to add no-load, low-cost, tax-efficient mutual funds, which gave you exposure to asset classes such as international (companies listed on stock exchanged located outside the United States, emerging markets (companies listed on stock exchanges located in the developing countries), or Real Estate Investment Trusts (portfolio’s of real estate investments that are developed and trade similar to mutual funds).

Finally, the fourth level represents the phase in which you develop your opportunistic assets, such as individual stocks and sector funds. Truthfully, you do not ever need to purchase individual assets or sector funds. But if you want to, they can be an important part of an investment portfolio. But they should be a small part.

Levels two, three, and four are also divided in terms of taxable assets and retirement assets. Taxable assets are assets on whose generated earnings you will need to pay taxes each year. Retirement assets are assets that you will not need until after you retire and on whose generated earnings you do not pay taxes until you take the money out at retirement. The breakdown of your assets between your taxable and retirement accounts will depend on your personal goals and your available retirement vehicles.

The bottom of the investment hourglass illustrates three important principles. First, it illustrates the importance of keeping risk in perspective. The base of the hourglass encompasses the least risky investments. As you move up the hourglass, you take on higher risk and, hopefully, higher returns. Second, the hourglass teaches you the “how to” of investing. You should invest in lower-risk assets first and then expand your portfolio to increase its potential for greater risk and more return as the size of your assets increases. Third, the investment hourglass separates taxable assets and retirement assets. The impact that taxes have on these two types of accounts is not the same, so retirement and taxable assets should be managed differently.