|

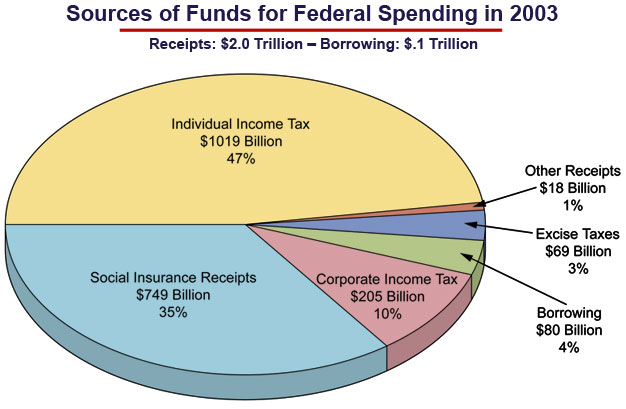

Fiscal PolicyFiscal policy is established by the Congress and the president through the federal budget process. Through this process, the federal government determines who will be taxed, what types of income and activities will be taxed at what rates, and what will be done with the money that is collected. Taxation and SpendingThe sources of federal government revenue and the federal government’s allocation of expenditures are illustrated in the following pie chart. Notice that the single largest source of federal government revenue is individual income taxes. The second largest source is “Social Insurance Receipts,” which are intended to pay for Social Security and low-income health insurance. Half of these “receipts” are paid directly out of individuals’ paychecks (FICA) and the other half is matched by their employers. Because employers generally take this amount out of what they would have paid their employees in the first place, it amounts to an additional indirect tax on individual workers. Consequently, some people refer to this second half of social insurance taxes as a “hidden tax.” In addition to the individual income, corporate, and payroll taxes collected at the national level, individuals, businesses, and other entities are also required to pay similar taxes to state and local governments. Sales taxes and property taxes are also collected by state and local governments.

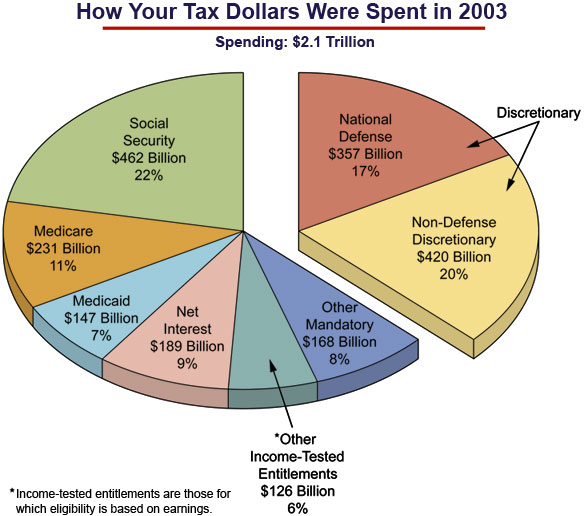

Government spending is generally divided into two categories: discretionary and non-discretionary. The Congress has complete control, or discretion, over less than 40 percent of the entire national budget. More than 60 percent of federal spending goes to non-discretionary expenditures that the Congress is required to make. These kinds of expenditures include interest on the national debt and “entitlement” programs, such as Social Security and Medicare. The Congress does not have the discretion to spend what it chooses on these programs because the Congress has established formulas that require benefits to be paid to anyone who qualifies for (or is “entitled” to) them. If more people qualify, the total amounts spent on these programs goes up. For example, if the number of people who qualify for Social Security goes up, the government has to spend more money on Social Security. This is particularly problematic for Social Security spending because large numbers of individuals are projected to retire over the next several years, which will make it difficult (if not impossible) to pay all of the individuals who are entitled to receive benefits under the program.

This work is licensed under a Creative Commons Attribution-Noncommercial-Share Alike 3.0 Unported License |

About Us | Terms of Use | Contact Us | Partner with Us | Press Release | Sitemap | Disclaimer | Privacy Policy

©1999-2011 OpenLearningWorld . com - All Rights Reserved