Free Online Course in International Business

Knowledge Statement

Knowledge of Mitigating Techniques: Credit Risk Insurance

Goal

The goal of this material is to introduce you to mitigating

techniques for commercial risk associated with international

transactions.

Learning Objectives

You will be able to

• identify techniques for mitigating commercial risk.

• identify when to use each technique.

Introduction

This lesson discusses what an international credit manager might do

to mitigate the risk of nonpayment and when to do it. An

international credit manager, to be successful in global business,

needs to be able to identify and describe techniques for managing

nonpayment risk.

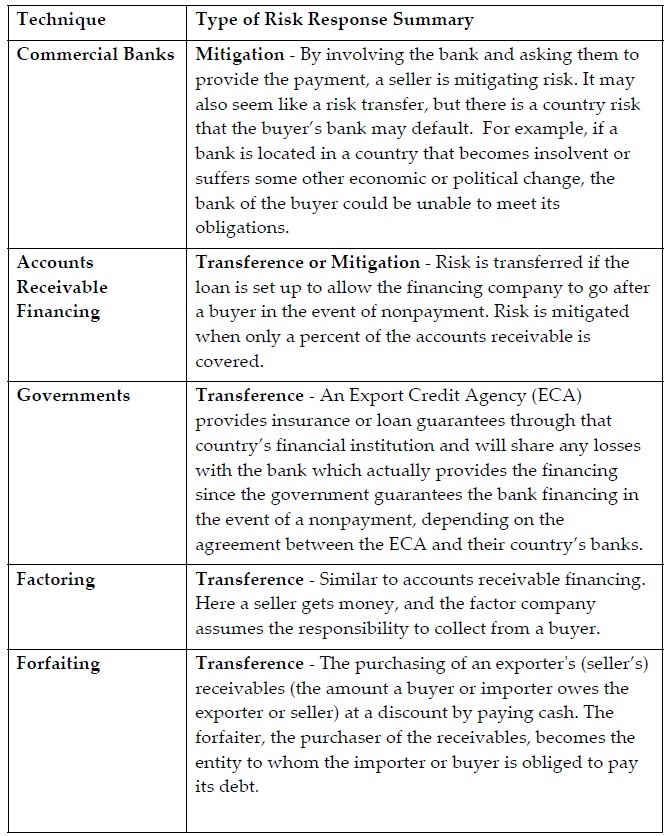

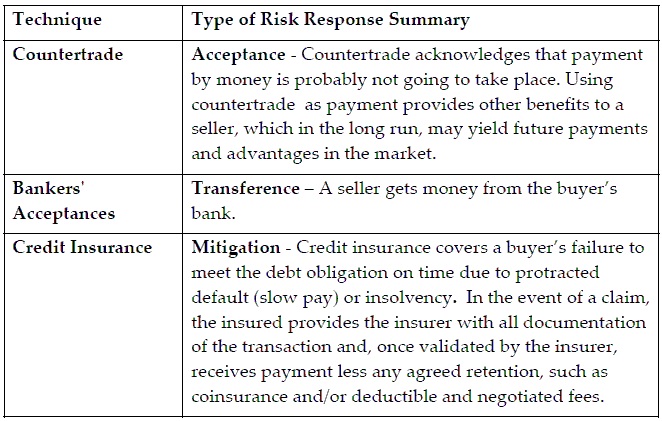

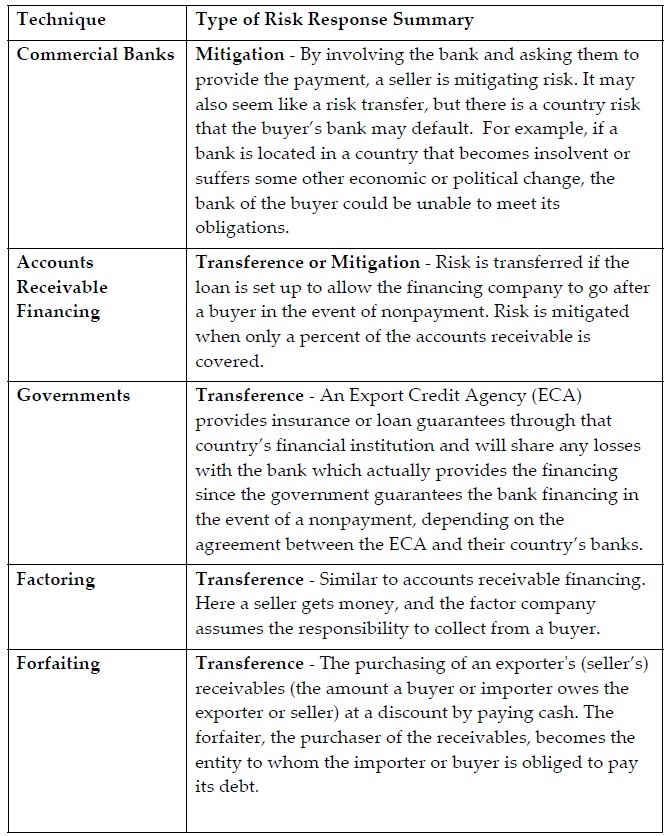

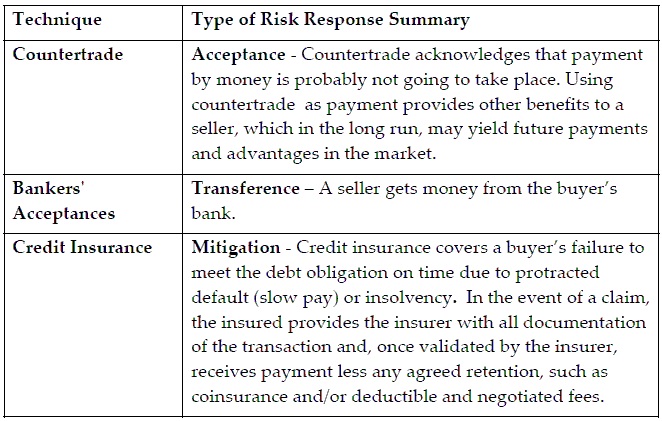

There are four types of reactions to risk situations that a seller or

exporter can take regarding nonpayment by the buyer:

• Avoidance: Don’t sell on credit.

• Transference: Ask a third party to assume the risk, such as a

buyer’s bank.

• Mitigation: Take precautions that reduce the probability that

nonpayment will occur, such as performing a complete credit check.

• Acceptance: Establish a contingency allowance for nonpayment

accounts.

Sellers will use all of the above depending on the buyer and the

specific circumstances associated with the sale. This section

provides a brief summary of the following techniques used for

responding to and managing the risk of nonpayment.

Commercial Banks - Mitigation

Commercial banks, the largest financial sector in most countries,

are usually short term lenders. The principal international trade

products that they offer are loans, letters of credit and

documentary draft collections. If a seller wants a third party to

assume the risk of nonpayment on behalf of a buyer, it is important

that this seller have a positive relationship with financial

institutions. Understanding the way banks operate in terms of making

funds available to buyers can provide an international credit

manager with a more complete understanding of the risk associated

with extending credit to a buyer. International credit managers may

work with a buyer in helping to find working capital financing, if

the buyer does not already have a banking relationship. Of course,

the credit worthiness of the buyer is critical to obtaining either

short term or long term financing. When an international credit

manager encounters a situation where shipments need to be made and

there is little justification for open credit, a letter of credit

can also be used as a bank financing opportunity for the

international transactions.

|